How You Can Buy Property from the Land Bank for $1

That title isn’t mere clickbait: it is possible to buy property from the Philadelphia Land Bank for one dollar. Maybe a little more, depending on which one you choose. As is the case with all good deals in life, however, there’s fine print attached.

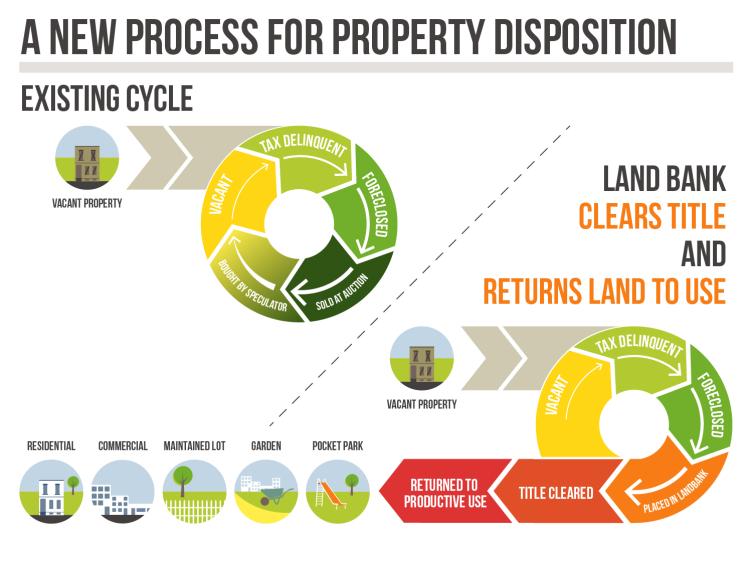

The Philadelphia Land Bank aims to try and return vacant properties to productive use. Under one program that they have for interested developers, you could own a neighboring property for as little as $1.

The Land Bank consists of thousands of distressed, vacant, and tax-delinquent properties scattered throughout the city. Since it opened in 2015, the Bank has been steadily trying to address the issue of blight in the City of Brotherly Love by scooping up properties that would otherwise drag down the value of neighborhoods. It’s estimated that there are some 40,000 vacant properties in Philadelphia. One of them could be yours, and at a very affordable price. You could use the lot to build a new house, create a community garden, or take a crumbling property and make it whole again.

Here are the requirements for a low-price purchase from the Land Bank. First of all, the lot or property in question must share a border with your own, existing home. That’s right: this deal is only good if you are neighbors with a blighted property. Secondly, the property’s value must be less than $25,000. It must be less than 3,000 square feet in size, and you must be the only interested buyer. No bidding wars here!

If you have identified a lot or property that meets all the criteria, you can log into the Land Bank’s website, submit an Expression of Interest (EOI) and a plan outlining what you want to do with the lot and how you plan on financing the purchase. You will next be asked to fill out a Tax Status & Disclosure form which will let the city do some probing to ensure that you have no liens on your existing home or have ever been involved in a crime-related foreclosure. After all this clears, the city will reduce the amount you need to close on the deal by up to $15,000. This means that, if you find a property worth $15,001, you will only pay $1 for it. You will also have to pay closing costs, which can run $1,000 or more.

One more note, according to Curbed Philadelphia: “The City will place what’s called a “soft second self-amortizing mortgage” on the property for its value. If you fail to maintain the property or sell it at a profit within 10 years, the City will call in the mortgage and you will have to pay some or all of that amount.”